Are you in a financial pinch and need quick access to cash? Perhaps an unexpected bill has caught you off guard, or you’re facing a sudden emergency.

Don’t worry – in Kenya, you don’t need a smartphone or internet access to secure a fast loan. Thanks to USSD (Unstructured Supplementary Service Data) codes, you can instantly connect with mobile loan providers right from your basic feature phone.

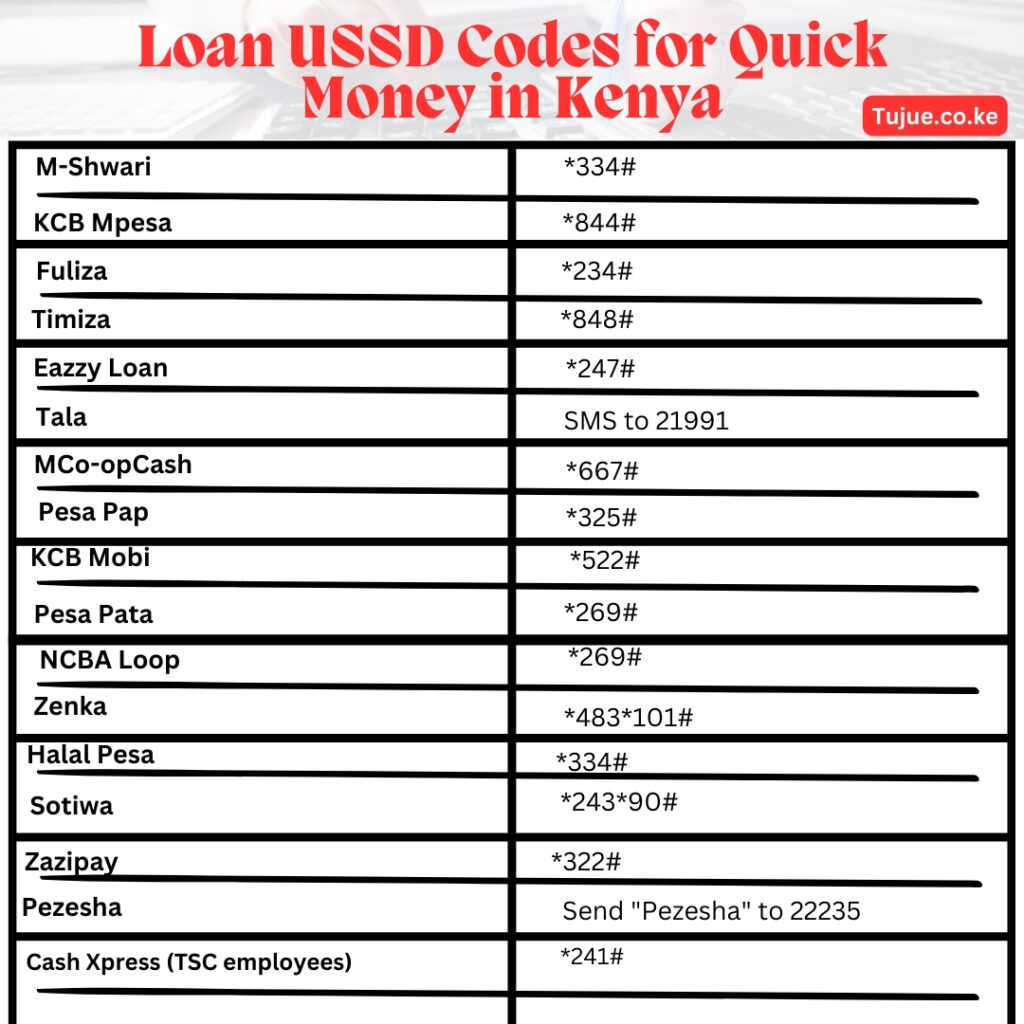

Let’s take a look at some top loan USSD Codes that can help you access instant loans when you need them most.

Also Read:

Best Loan Apps in Kenya Without CRB Check

How to Get 100,000 Interest Free Safaricom Faraja Loan

Free USSD Codes for MPESA Loans in Kenya

No smartphone? No problem. No internet connection? That’s fine too. With just a few taps on your phone’s keypad, you can apply for a loan and receive funds in your M-Pesa account within minutes.

Here’s a list:

| Service Name | Provider (Lender) | USSD Code / SMS Number |

|---|---|---|

| M-Shwari | NCBA Bank | *334# |

| KCB Mpesa | KCB Bank | *844# |

| Fuliza | Safaricom, KCB, NCBA | *234# |

| Timiza | Barclays Banks | *848# |

| Eazzy Loan | Equity Bank | *247# |

| Tala | InVenture Mobile Limited | SMS to 21991 |

| MCo-opCash | Cooperative Bank | *667# |

| Pesa Pap | Family Bank | *325# |

| KCB Mobi | KCB Bank | *522# |

| Pesa Pata | Paddy Micro Investments | *269# |

| NCBA Loop | NCBA Bank | *654# |

| Zenka | Zenka Finance | *483*101# |

| Halal Pesa (Sharia compliant) | Gulf African Bank | *334# |

| Sotiwa | Sotiwa Ltd | *243*90# |

| Zazipay | MyCredit | *322# |

| Pezesha | Pezesha Africa Ltd | Send “Pezesha” to 22235 |

| Cash Xpress (TSC employees) | Premier Credit | *241# |

| Kopa Doh | Mobile Opulence Ltd | *610# |

| Pesa ChapChap | Faulu Microfinance Bank | *339# |

| ExtendMoney | ExtendMoney Services | *676# |

| HF Whizz | HFC Group | *618# |

| Bayes Pi | Capital Ltd | *879*99# |

| M-Fanisi | Maisha Bank | *281# |

| Kopa Cash (Airtel Money) | Jumo Mobile | *222# or *334# |

| Express (Airtel Money) | Ecobank | *222# or *334# |

| Okoa Sasa (TSC Teachers) | Okoa Sasa | *884# |

| Okoa Mia | OkoaMia Ventures | *628# |

USSD Codes for Banks that Offer Quick Loans in Kenya

In Kenya, getting a quick loan is easier than you might think.You don’t have to rely on loan lending Apps from less known institutions; you can also go for the big banks and try your luck. However, note that most of these banks may require you to register an account with them and possibly check your CRB status.

But it doesn’t hurt to try, right?

Take a look

| Service Provider | USSD Code |

|---|---|

| Sotiwa | *243*90# |

| MyCredit | *322# |

| Standard Chartered Bank | *722# |

| SMEP Microfinance Bank | *741# |

| Commercial Bank of Africa | *654# |

| Consolidated Bank | *262# |

| Diamond Trust Bank | *385# |

| Equatorial Commercial Bank | *286# |

| Equity Bank of Kenya | *247# |

| Extend Money Services | *676# |

| K-Rep Bank | *527# |

| Kenya Women Finance Trust | *378# |

| Musomi Microfinance Institution | *279# |

| Maisha Bank | *281# |

| National Bank | *625# |

| NCBA Bank | *654# |

| Ndege Chai Sacco | *882# |

| NIC Bank Limited | *488# |

| Kopa doh | *610# |

| Paddy Micro Investments | *269# |

| Telkom | *133# |

| Pi Capital Ltd | *879*99# |

| Premier Credit | *241# |

| Stanbic Bank | *208# |

| Chase Bank of Kenya | *275# |

| Safaricom/NCBA/KCB Bank | *234# |

| Gulf Africa Bank | *399# |

Here’s a visual presentation:

Loan USSD Codes for Quick Money in Kenya Infographic

Key Takeaway

Financial emergencies can strike at any moment. Thankfully, with these USSD codes at your fingertips, you’re never far from a quick financial solution. Whether you’re dealing with unexpected bills, medical emergencies, or just need a little extra cash to tide you over, these mobile loan services offer a lifeline when you need it most.

Remember, while these loans provide convenient access to quick cash, it’s crucial to borrow responsibly. Always read the terms and conditions carefully, understand the interest rates and repayment periods, and only borrow what you can comfortably repay. These services are tools to help you navigate short-term financial challenges, not long-term financial solutions.

Keep this list of USSD codes handy – you never know when you might need a financial boost. With just a few taps on your phone, you can access the funds you need, anytime and anywhere in Kenya. Stay empowered, stay informed, and use these services wisely to manage your financial needs effectively.