Are you planning to apply for a loan, seeking employment, or aiming to prove your creditworthiness? A CRB (Credit Reference Bureau) Clearance Certificate might be just what you need. This important document serves as a testament to your financial reliability and can open doors to various opportunities.

Many individuals are unaware of the process for obtaining this crucial certificate, or they might feel overwhelmed by the perceived complexity. In this guide, we’ll walk you through the step-by-step process of obtaining your CRB Clearance Certificate. Whether you’re a first-timer or looking to update your existing certificate, we’ve got you covered.

Let’s embark on this journey to understand and obtain your CRB Clearance Certificate, paving the way for a brighter financial future!

Also read: How To Check CRB Score In Kenya

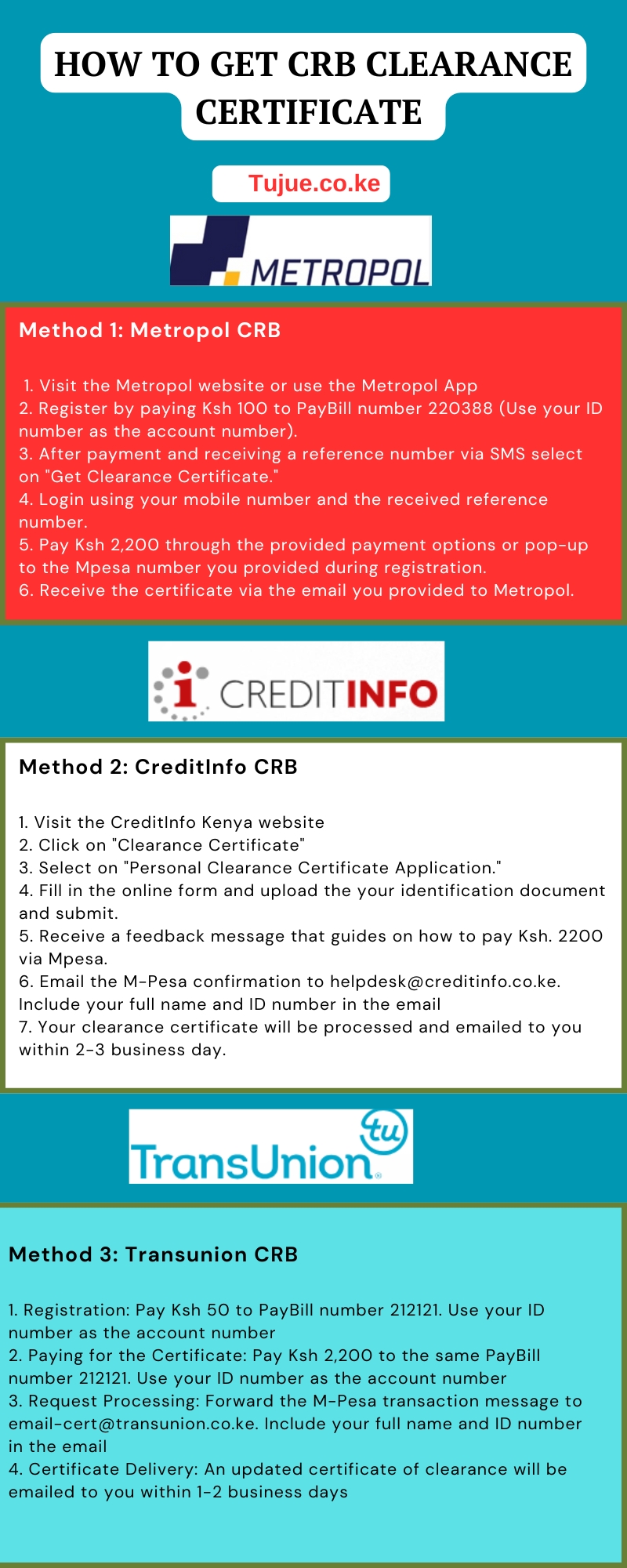

Getting Your CRB Clearance Certificate In Kenya

In Kenya, three licensed Credit Reference Bureau institutions are authorized to provide CRB Clearance certificate.

How To Get CRB Clearance Certificate Infographic

Metropol CRB

Metropol offers both online and offline methods to obtain your clearance certificate:

Online Method

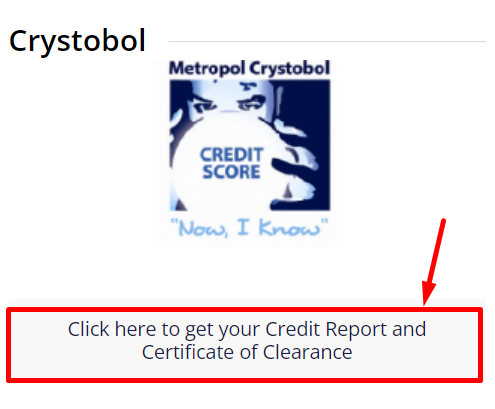

1. Visit the Metropol website (www.metropol.co.ke) or use the Metropol App

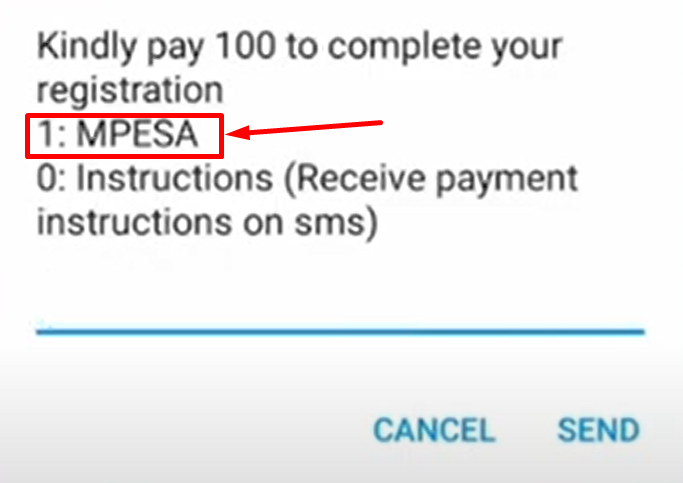

2. Register by paying Ksh 100 to PayBill number 220388 (Use your ID number as the account number).

3. After payment and receiving a reference number via SMS select on “Get Clearance Certificate.”

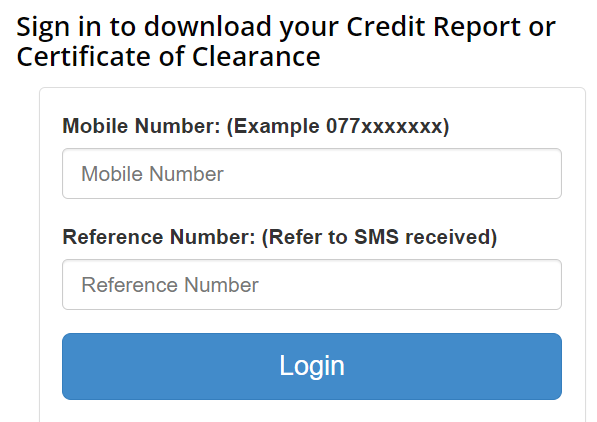

4. Login using your mobile number and the received reference number.

5. Pay Ksh 2,200 through the provided payment options or pop-up to the Mpesa number you provided during registration.

6. Receive the certificate via the email you provided to Metropol.

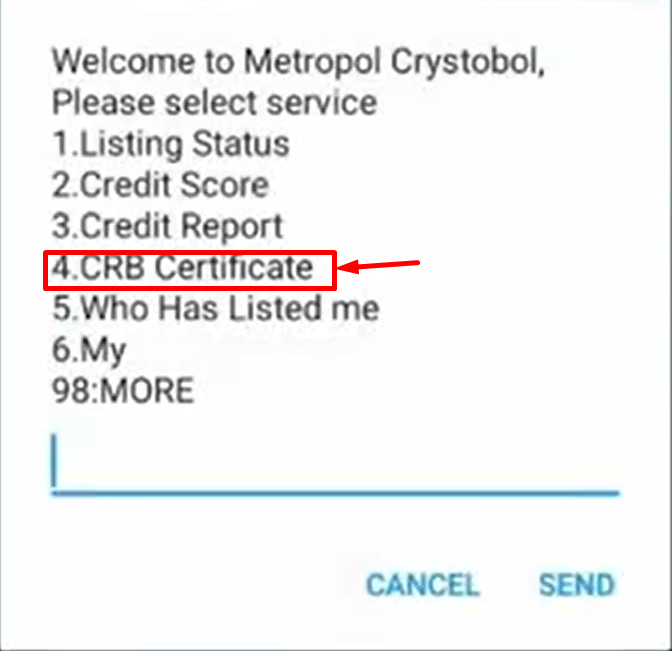

Using USSD Method

1. Dial *433#

2. Select “CRB Certificate”

3. Follow the prompts to make the Ksh 2,200 payment

In-Person Method

1. Visit any Metropol CRB office

2. Provide your ID and pay Ksh 2,200

3. Your certificate will be processed and issued on the spot

Note on certificate delivery

For online and USSD methods, the certificate is usually emailed within 24 hours

For urgent processing, an additional fee may apply

TransUnion CRB

TransUnion offers a straightforward process for obtaining your clearance certificate:

1. Registration

– Pay Ksh 50 to PayBill number 212121

– Use your ID number as the account number

2. Paying for the Certificate

– Pay Ksh 2,200 to the same PayBill number 212121

– Use your ID number as the account number

3. Request Processing

– Forward the M-Pesa transaction message to email-cert@transunion.co.ke

– Include your full name and ID number in the email

4. Certificate Delivery

– An updated certificate of clearance will be emailed to you within 1-2 business days

Notes:

– For urgent processing (same-day service), there’s an additional fee of Ksh 1,000

– You can also visit their physical offices in major towns for in-person service

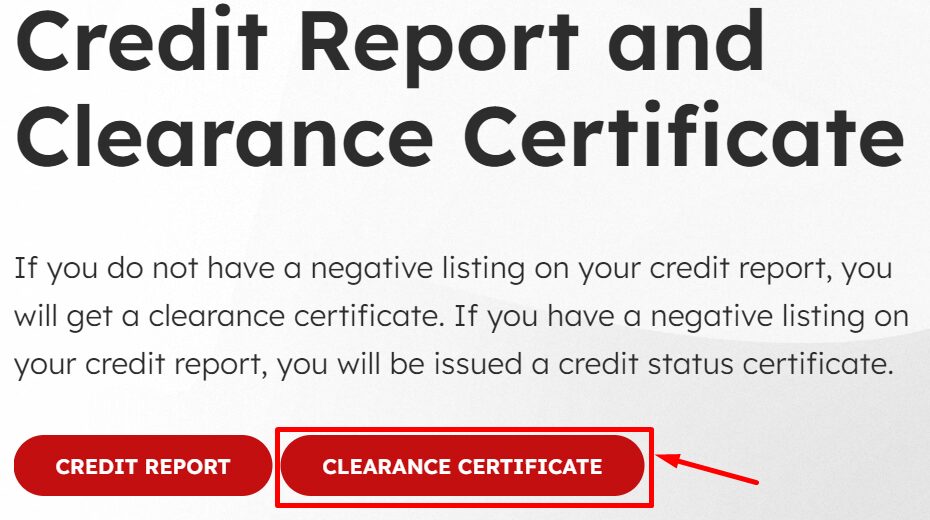

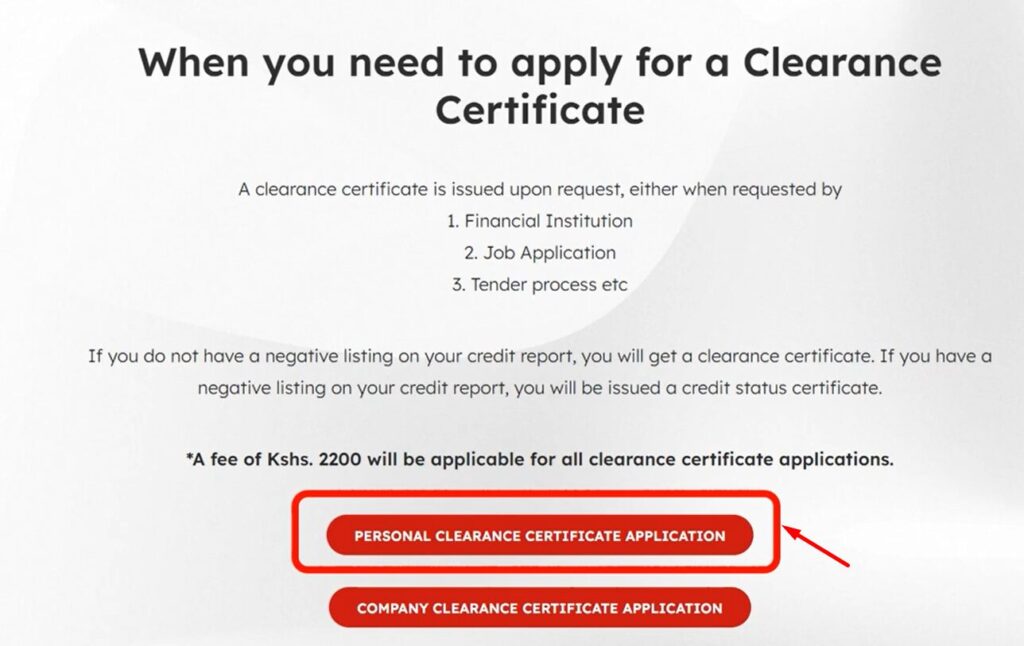

CreditInfo CRB

CreditInfo has a slightly different process which is done via the website.

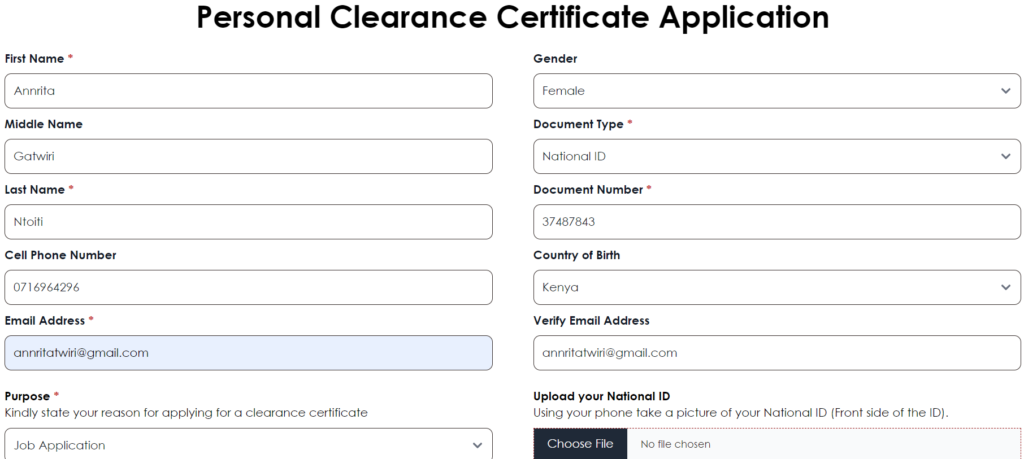

1. Visit the CreditInfo Kenya website www.creditinfo.co.ke

2. Click on “Clearance Certificate”

3. Select on “Personal Clearance Certificate Application.”

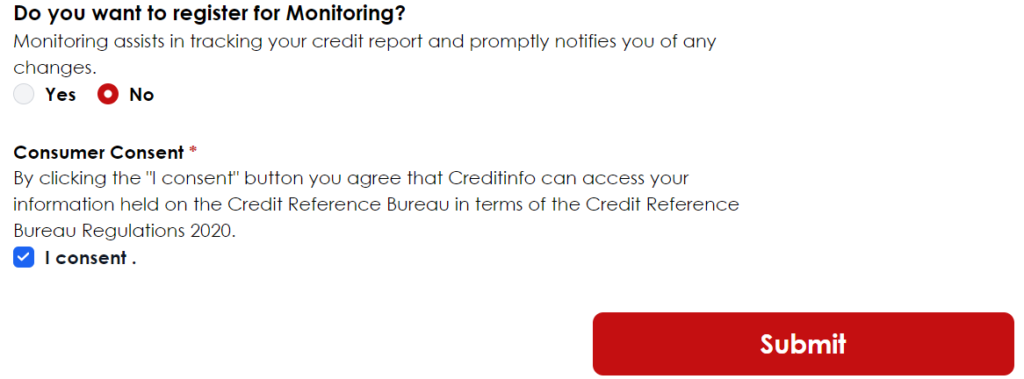

4. Fill in the online form and upload the your identification document and submit.

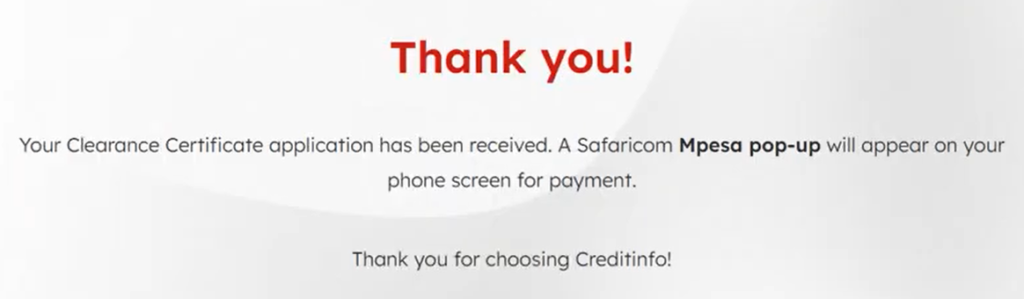

5. Receive a feedback message that guides on how to pay Ksh. 2200 via Mpesa.

6. Email the M-Pesa confirmation to helpdesk@creditinfo.co.ke. Include your full name and ID number in the email

7. Your clearance certificate will be processed and emailed to you within 2-3 business days

Note: If you are listed by any credit facility, you cannot download a CRB clearance certificate. You will first have to clear the loan with the facility/lending institution and after your credit status is updated you can download the certificate.

Reasons For Getting A CRB Kenya Certificate Of Clearance

1. Loan Applications: After being previously listed adversely (as a defaulter), a COC can demonstrate to lenders that you’ve resolved past issues and are now creditworthy. Hence financial institutions like banks (KCB, Equity among others) and mobile loan lending facilities can trust you with loans.

2. Employment Applications: Some employers, especially in the financial sector, may request a COC as part of their background check process.

3. Business Opportunities: When applying for business licenses or tenders, a COC might be required to prove financial reliability.

4. Rental Applications: Landlords might ask for a COC to assess your financial responsibility before renting out property.

5. Visa Applications: Some countries may require a COC as part of their visa application process to assess your financial stability.

6. Peace of Mind: A COC provides reassurance about your credit status, confirming that you’re in good standing with lenders.

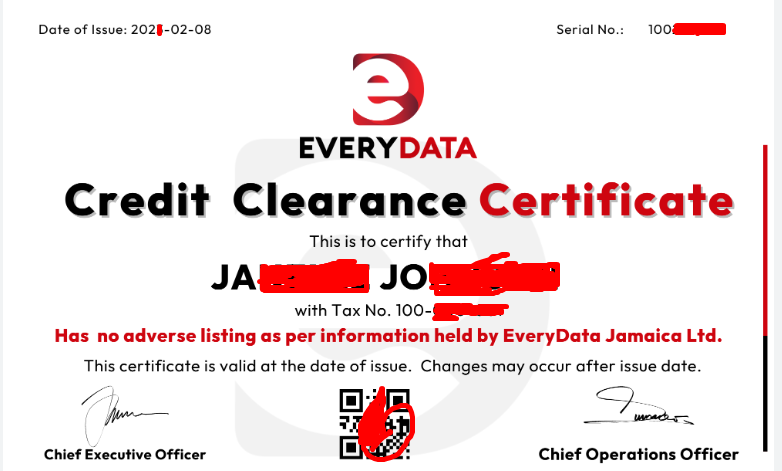

Validity Of A Certificate Of Clearance

A COC is valid only on the date of issue. This limited validity is due to the dynamic nature of credit information including:

1. Daily Updates: CRBs receive new information daily, which could potentially alter your credit status.

2. Real-Time Reflection: The certificate reflects your credit status at a specific point in time.

3. Lender Requirements: Most lenders or institutions will only accept a COC that’s very recent, often not more than 30 days old.

Key Takeaway

Obtaining your CRB Clearance Certificate is a straightforward process that can significantly impact your financial opportunities. You can use either Metropol, CreditInfo or Transunion using the different methods they offer to get the certificate. For all the methods, you need to pay Ksh. 2200 as a fee before the certificate is issued.

Remember, staying proactive about your credit status not only helps you maintain good financial standing but also positions you favorably for future loans, employment opportunities, and other financial endeavors.