Do you ever wonder how much you spend sending money through MPESA or withdrawing from MPESA Agents? If you do a lot of transactions, it could be a considerable number.

This is why you need to understand the transaction costs every time you use your MPESA.

This guide breaks down all the new MPESA charges to help you manage your mobile money transactions more effectively.

Also Read: How to Reverse MPESA Transaction Sent to Wrong Number

New MPESA Fees in 2024 and 2025

Whether you’re sending money to family, paying for services, or managing business transactions, knowing these new Mpesa charges will help you plan your finances better and avoid unexpected costs.

Let us look at the charges…

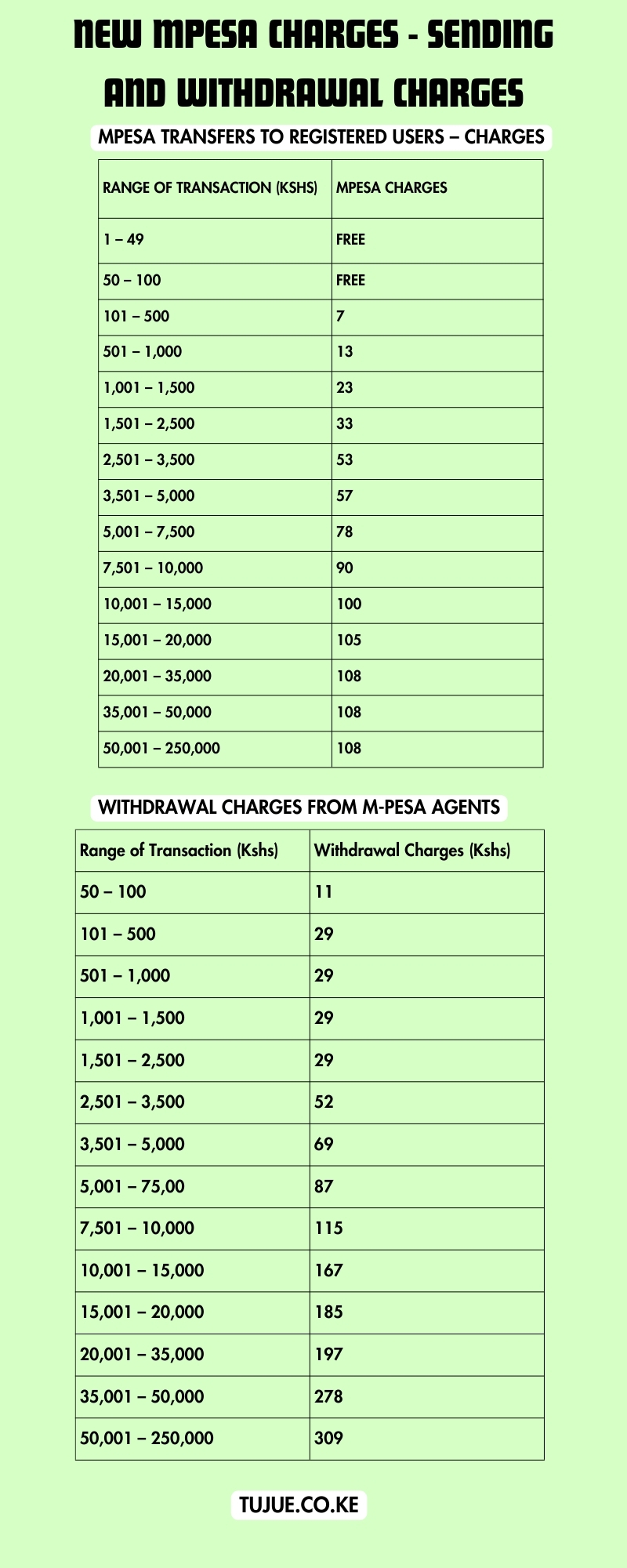

Mpesa Transfers to Registered Users – Charges

Moving money between M-PESA users is one of the platform’s most frequently used features. The charges for these transfers are structured on a tiered system, taking into account the transaction amount.

Safaricom has designed these charges to be competitive while ensuring the service’s sustainability.

| Range of Transaction (Kshs) | Mpesa charges |

|---|---|

| 1 – 49 | FREE |

| 50 – 100 | FREE |

| 101 – 500 | 7 |

| 501 – 1,000 | 13 |

| 1,001 – 1,500 | 23 |

| 1,501 – 2,500 | 33 |

| 2,501 – 3,500 | 53 |

| 3,501 – 5,000 | 57 |

| 5,001 – 7,500 | 78 |

| 7,501 – 10,000 | 90 |

| 10,001 – 15,000 | 100 |

| 15,001 – 20,000 | 105 |

| 20,001 – 35,000 | 108 |

| 35,001 – 50,000 | 108 |

| 50,001 – 250,000 | 108 |

Withdrawal Charges from M-PESA Agents

M-PESA agents form the backbone of the cash withdrawal network, providing essential services across Kenya. The withdrawal charges at agents are calculated based on the amount being withdrawn, with different tiers designed to accommodate various transaction sizes.

These new Mpesa charges balance convenience with operational costs, ensuring agents can maintain their services while keeping the service accessible to users.

| Range of Transaction (Kshs) | Withdrawal charges (Kshs) |

|---|---|

| 50 – 100 | 11 |

| 101 – 500 | 29 |

| 501 – 1,000 | 29 |

| 1,001 – 1,500 | 29 |

| 1,501 – 2,500 | 29 |

| 2,501 – 3,500 | 52 |

| 3,501 – 5,000 | 69 |

| 5,001 – 75,00 | 87 |

| 7,501 – 10,000 | 115 |

| 10,001 – 15,000 | 167 |

| 15,001 – 20,000 | 185 |

| 20,001 – 35,000 | 197 |

| 35,001 – 50,000 | 278 |

| 50,001 – 250,000 | 309 |

Mpesa ATM Withdrawal Charges

ATM withdrawals offer another convenient way to access your M-PESA funds. This service bridges traditional banking with mobile money, allowing users to withdraw cash without visiting an agent.

The charges for ATM withdrawals are typically higher than agent withdrawals but offer the advantage of 24/7 accessibility and the convenience of using banking infrastructure.

| Range of Transaction (Kshs) | ATM Withdrawal Fee (Kshs) |

|---|---|

| 200 – 2,500 | 35 |

| 2,501 – 5,000 | 69 |

| 5,001 – 10,000 | 115 |

| 10,001 – 35,000 | 203 |

Business Till to Customer and Pochi la Biashara Charges

These specialized business services cater to different scales of enterprise, from small shops to large corporations. The MPESA Till to Customer service facilitates business-to-consumer payments, while Pochi la Biashara is designed for small-scale entrepreneurs.

The charges for these services are structured to support business operations while maintaining affordability for both merchants and customers.

| Range of Transaction (Kshs) | Mpesa charges |

|---|---|

| 1 – 49 | FREE |

| 50 – 100 | FREE |

| 101 – 500 | 7 |

| 501 – 1,000 | 13 |

| 1,001 – 1,500 | 23 |

| 1,501 – 2,500 | 33 |

| 2,501 – 3,500 | 53 |

| 3,501 – 5,000 | 57 |

| 5,001 – 7,500 | 78 |

| 7,501 – 10,000 | 90 |

| 10,001 – 15,000 | 100 |

| 15,001 – 20,000 | 105 |

| 20,001 – 35,000 | 108 |

| 35,001 – 50,000 | 108 |

| 50,001 – 250,000 | 108 |

Mpesa Transactions That Are Free

To promote financial inclusion and service accessibility, several M-PESA transactions remain free of charge. This approach helps users maximize the value of the service while keeping essential financial services accessible to all segments of society.

Understanding which transactions are free can help users optimize their usage and reduce transaction costs.

| Type of Transaction | Charge (Kshs) |

|---|---|

| All deposits | FREE |

| M-PESA registrations | FREE |

| Buying airtime | FREE |

| M-PESA balance enquiry | FREE |

| Change M-PESA PIN | FREE |

Important Transaction Limits

Maximum Mpesa Account Balance: Kshs. 500,000

Maximum Daily Transaction: Kshs. 500,000

Maximum Amount Per Transaction: Kshs. 250,000

Minimum Agent Withdrawal Amount: Kshs. 50

New Mpesa Charges – Sending and Withdrawal Charges

Final Thoughts

M-PESA continues to evolve, adapting its charges and services to meet user needs while maintaining operational sustainability. Understanding these new Mpesa charges helps users make informed decisions about their transactions and manage their mobile money effectively.

Whether you’re a casual user or a business owner, staying updated on these charges ensures you can maximize the benefits of M-PESA’s services while minimizing transaction costs.