(This article is meant for information purposes and doesn’t constitute as investment advice)

We can all agree on one thing. Cryptocurrency has become a hot topic in recent years, with many people curious about how to get involved but feeling overwhelmed by the technical jargon and complex concepts.

I will demystify the world of cryptocurrency investing, breaking down the key steps and ideas into easy-to-understand language. I will keep this simple and straightforward, so that even the novice of users can understand the process of investing in cryptocurrency.

It seems like a complex thing, but trust me; it’s easy if you know the basics of crypto.

Let’s get to it!

Also read: Top Digital Skills You Can Learn Right Now for a Living

How Do You Invest in Crypto? Popular Types of Cryptocurrency Investing

Investing in cryptocurrency can seem daunting at first, but there are several popular methods that cater to different levels of experience and risk tolerance.

This section will break down the most common ways to invest in crypto (Buying and Holding and Crypto Trading).

How Does Investing in Cryptocurrency Work Infographic

1. Buy Cryptocurrency Directly and Hold

This method, often referred to as “HODLing” (a misspelling of “holding” that became popular in crypto communities), is the simplest and most straightforward way to invest in cryptocurrency.

How it works:

1. Choose a cryptocurrency exchange or platform such a Binance or Coinbase

2. Create an account and verify your identity

3. Deposit funds, usually via bank transfer, P2P (per to peer) or credit card

4. Buy the cryptocurrency of your choice

5. Store your cryptocurrency securely (preferably in a personal wallet)

6. Hold onto your investment for an extended period

7. Sell your crypto when the price is high, and withdraw your funds.

Advantages of Buying and Holding

– Simple and easy for beginners

– Requires minimal time and effort once the initial purchase is made

– Huge long-term gains if the chosen cryptocurrency increases in value

Risks of Buying and Holding

– Cryptocurrency prices are highly volatile, so prices can sometimes go lower than your entry point.

– No guaranteed returns

– Requires patience and ability to withstand market ups and downs

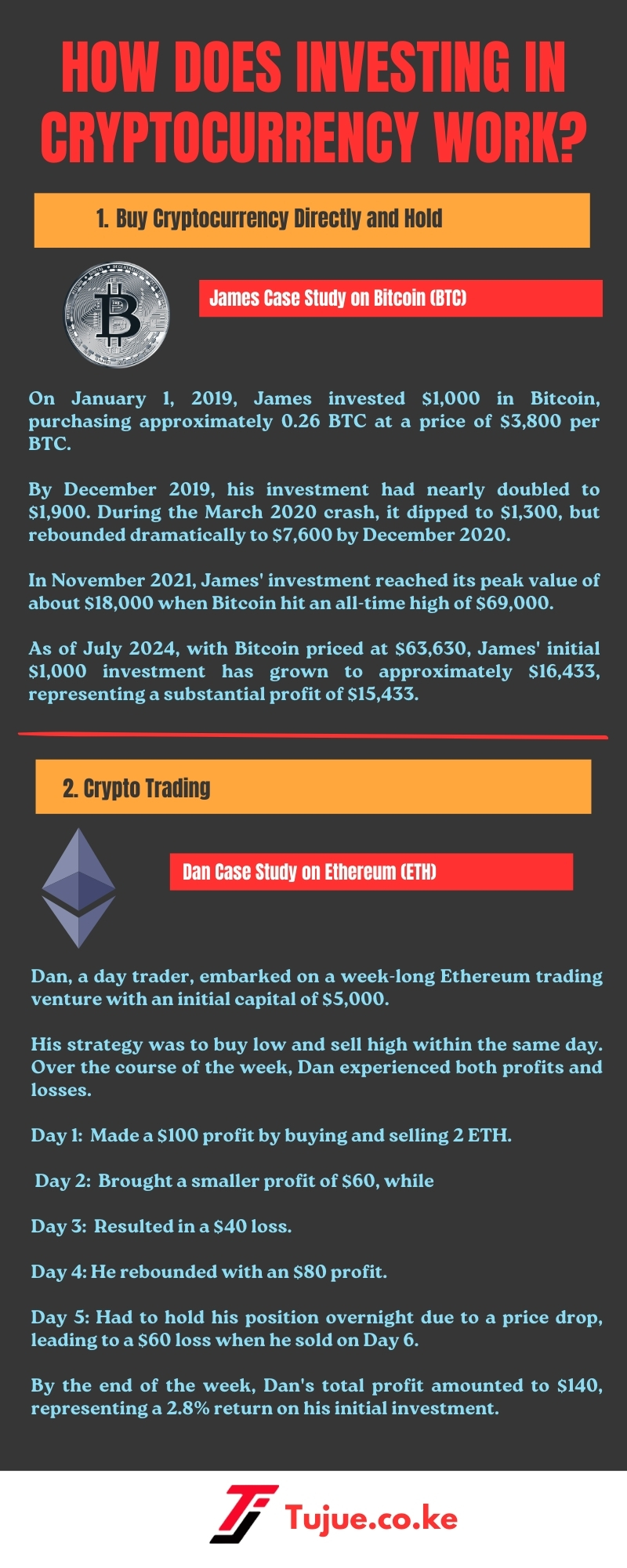

Case Study: Bitcoin Investment

Let’s consider a hypothetical investor named James who decided to invest in Bitcoin using the buy-and-hold strategy:

– Date of purchase: January 1, 2019

– Amount invested: $1,000

– Bitcoin price at purchase: Approximately $3,800 per BTC

– Amount of Bitcoin purchased: About 0.26 BTC

James decided to hold his Bitcoin regardless of market fluctuations. Here’s how his investment would have performed:

– By December 2019: Bitcoin price reached about $7,200. James’ investment would be worth around $1,900.

– During the March 2020 crash: Bitcoin dropped to about $5,000. James’ investment would be worth about $1,300.

– By December 2020: Bitcoin surged to about $29,000. James’ investment would be worth around $7,600.

– In November 2021: Bitcoin hit an all-time high of about $69,000. James’ investment would have peaked at about $18,000.

– As of July 2024 (time of this writing): Bitcoin price is around $63,630.00. James’ investment would be worth about $16,433.

This case study shows both the potential gains and the volatility associated with buying and holding cryptocurrency. Despite significant price swings, James’ initial $1,000 investment would have grown substantially to give him a profit of $62,630.

Note: It’s important to note that past performance doesn’t guarantee future results, and the cryptocurrency market remains highly unpredictable. Investors should only invest what they can afford to lose and should thoroughly research before making any investment decisions.

2. Crypto Trading

This one is a bit complex, but if you understand the first type of investment, I’m sure you can breeze through this one as well.

Crypto trading involves actively buying and selling cryptocurrencies to profit from short-term price fluctuations. This method requires more time, knowledge, and risk tolerance than buy-and-hold strategies.

How it works:

1. Choose a cryptocurrency exchange with advanced trading features. Binance is a good choice here.

2. Create and fund your account

3. Study market trends, technical analysis, and trading strategies

4. Place buy and sell orders based on your analysis

5. Monitor your trades closely

6. Close positions to realize profits or limit losses

Advantages:

– Potential for short-term profits

– Opportunity to benefit from both rising and falling markets

– Develops deeper understanding of crypto markets

– Can be exciting and engaging for those who enjoy active investing

Risks:

– High risk of losses, especially for inexperienced traders

– Requires significant time commitment

– Emotional stress from market volatility

– Potential for addiction-like behavior

Case Study: Day Trading Ethereum

Let’s consider a hypothetical trader named Dan who decided to day trade Ethereum:

– Starting capital: $5,000

– Trading period: One week

– Strategy: Buy low, sell high within the same day

Day 1:

– Bought 2 ETH at $1,900 each: $3,800

– Sold 2 ETH at $1,950 each: $3,900

– Profit: $100

Day 2:

– Bought 2 ETH at $1,880 each: $3,760

– Sold 2 ETH at $1,910 each: $3,820

– Profit: $60

Day 3:

– Bought 2 ETH at $1,920 each: $3,840

– Sold 2 ETH at $1,900 each: $3,800

– Loss: $40

Day 4:

– Bought 2 ETH at $1,890 each: $3,780

– Sold 2 ETH at $1,930 each: $3,860

– Profit: $80

Day 5:

– Bought 2 ETH at $1,940 each: $3,880

– ETH price dropped, held overnight

Day 6:

– Sold 2 ETH at $1,910 each: $3,820

– Loss: $60

Week’s Result:

– Total profit: $140

– Return on investment: 2.8%

This case study shows the potential for both quick profits and losses in crypto trading. Dan made money on some days but lost on others.

Note: It’s important to note that this example is simplified and doesn’t account for trading fees, which can significantly impact profitability, especially with frequent trading. Additionally, many traders experience larger losses, particularly when starting out.

Successful crypto trading requires discipline, emotional control, and a solid understanding of market dynamics. It’s generally not recommended for beginners or those who can’t afford to lose their investment. Always start with small amounts, use stop-loss orders to limit potential losses, and never trade with money you can’t afford to lose.

Is Cryptocurrency Actually a Good Investment?

The question of whether cryptocurrency is a good investment doesn’t have a simple yes or no answer.

It depends on various factors, including your financial goals, risk tolerance, and market understanding. To make an informed decision, it’s crucial to consider both the advantages and disadvantages of investing in cryptocurrency.

However, most people believe that, with increased adoption and proper policies, crypto could be a game changer.

According to a professor of international business and strategy at Northeastern University (who’s also the author of ‘Enterprise Strategy for Blockchain’), Ravi Sarathy:

“This year, the big news is that the SEC finally accepted Bitcoin ETF, or exchange traded funds….Once the SEC was pushed to accept Bitcoin and say, ‘It’s OK to have an exchange traded fund,’ it became possible for a very large number of people to suddenly say, ‘Hey, I’ve been hearing about Bitcoin. Maybe now that it’s so easy, I should do it.’”

Now, let’s look at it in two different ways: why it might be a good investment, and why it might not.

Why Crypto Might be Seen as a Good Investment

- Potential for High Returns: One of the primary attractions of cryptocurrency as an investment is its potential for high returns. Early investors in Bitcoin and Ethereum, for example, saw astronomical gains. This growth continues to draw many investors to the crypto market.

- Investment in Blockchain: Cryptocurrency also represents an investment in innovative technology. Blockchain, the underlying technology of most cryptocurrencies, has potential applications far beyond finance. As such, some investors view crypto investments as a way to support and potentially profit from technological advancements.

- Mainstream Adoption: The increasing mainstream adoption of cryptocurrencies is another factor to consider. More companies and institutions are embracing digital currencies, which could lead to increased value and stability over time.

Why Crypto Might be Seen as a Bad Investment

- Volatile Market: Cryptocurrency investments come with significant risks. The market is notoriously volatile, with prices capable of dramatic swings in short periods. This volatility can lead to substantial losses, especially for inexperienced investors or those prone to making emotional decisions.

- Regulatory Uncertainty: This is another major concern. The legal and regulatory landscape for cryptocurrencies is still evolving in many jurisdictions.

- Changes in regulations: This could have profound impacts on the market, potentially affecting the value and usability of various cryptocurrencies.

- Security: While blockchain technology itself is generally secure, the exchanges and wallets used to store and trade cryptocurrencies can be vulnerable to hacking and theft. Losing access to your private keys can mean losing your entire investment.

- Environmental Impact: The environmental impact of some cryptocurrencies, particularly Bitcoin, has also become a growing concern. The energy-intensive process of mining Bitcoin has drawn criticism and could potentially lead to regulatory pressures or reduced adoption in the future.

Verdict?

When considering cryptocurrency as an investment, it’s crucial to assess your own financial situation and goals. Only invest what you can afford to lose, and consider how crypto fits into your overall financial strategy. Your risk tolerance is also a key factor – can you handle the potential for significant losses?

Which Crypto Is Best to Invest?

Determining the “best” cryptocurrency to invest in is a difficult decision that depends on various factors, including your investment goals, risk tolerance, and market outlook.

It’s important to note that the cryptocurrency market is highly volatile and what’s considered the best investment can change rapidly. However, I can provide an overview of some cryptocurrencies that are often considered by investors, along with factors to consider when making your decision.

1. Bitcoin (BTC)

BTC is often viewed as the safest and most established cryptocurrency. As the first and largest cryptocurrency by market capitalization, it has the longest track record and the highest level of adoption. Many investors consider Bitcoin as a store of value, similar to digital gold.

2. Ethereum (ETH)

ETH is the second-largest cryptocurrency and is known for its smart contract capabilities. It’s the backbone of many decentralized applications (DApps) and is central to the growing decentralized finance (DeFi) ecosystem. Investors interested in the potential of blockchain technology beyond simple transactions often consider Ethereum.

Note: Other major cryptocurrencies like Binance Coin (BNB) and Solana (SOL) each have their unique value propositions and ecosystems. These “altcoins” can offer higher returns but also come with increased risk.

When considering which crypto to invest in, look at factors such as:

– Market capitalization (the higher the better)

– Trading volume (the higher the better)

– Technology (What does the project intend to solve?)

– Development team (Are the members well known and have a solid track record?)

– Real-world use cases, and adoption rates.

Note: Consider your investment timeline. If you’re looking for short-term gains, your strategy might differ from someone investing for the long term. Some investors choose to hold a mix of established cryptocurrencies for stability and smaller, promising projects for growth potential.

Crypto scams and Frauds You Need to Watch Out For

The cryptocurrency space, while innovative, has unfortunately become a breeding ground for various scams and fraudulent activities. Investors need to be vigilant and aware of common tactics used by bad actors.

Here are some of the most prevalent crypto scams and frauds to watch out for:

1. Phishing Scams

These involve fake websites or emails that mimic legitimate cryptocurrency exchanges or wallets. Scammers aim to trick you into revealing your private keys or login credentials. Always double-check URLs and email addresses, and never click on suspicious links.

2. Pump and Dump Schemes

In these schemes, fraudsters artificially inflate the price of a low-value cryptocurrency through false statements and coordinated buying. Once the price rises, they sell their holdings, causing the price to crash and leaving other investors with significant losses. Be wary of sudden price spikes and aggressive promotion of lesser-known cryptocurrencies.

3. Ponzi Schemes

These scams promise high returns to early investors using money from later investors. Eventually, the scheme collapses when there aren’t enough new investors to pay earlier ones. Be cautious of any investment opportunity that promises unusually high or consistent returns.

4. Malware and Ransomware

Hackers may use malicious software to gain access to your computer or smartphone, stealing your private keys or holding your data for ransom. Keep your devices secure with up-to-date antivirus software and be cautious when downloading apps or clicking on links.

5. Fake Wallets

Scammers create fake wallet apps that steal users’ funds once they input their private keys. Only download wallet apps from official sources and check reviews carefully.

6. Cloud Mining Scams

These involve companies that claim to mine cryptocurrency on your behalf for a fee. Many are fraudulent and don’t actually own any mining equipment. Research thoroughly before investing in any cloud mining operation.

The Bottom Line

At its core, cryptocurrency investing involves buying and holding of digital assets that use blockchain technology. The key to successful cryptocurrency investing lies in understanding the technology, the market dynamics, and your own financial goals and risk tolerance.

As with any investment, due diligence is paramount. Do not quit your job yet because you see so much hype in crypt investments. Take the time to research different cryptocurrencies, understand their use cases, and evaluate their potential for long-term viability.