Are you frustrated with the sluggish growth of your savings account? You’ll love Money Market Funds (MMFs). These investment vehicles offer a perfect blend of security, liquidity, and competitive returns, making them an attractive option for both new and seasoned investors in Kenya.

We are going to look at the best money market funds in Kenya, each fund having its own strengths and downsides.

Remember, these rankings are purely based on research, and the lists are not in any particular order. We have covered a section of what to consider before choosing a Money Market Fund to help you narrow down the list to that one institution that suits your needs

As with any investment decision, it’s wise to consult with a financial ad visor to determine if Money Market Funds align with your personal financial goals and risk tolerance. With the right approach, MMFs can be a powerful tool to grow your wealth while maintaining the flexibility to access your funds when needed.

Also Read: How Does Investing in Cryptocurrency Work?

What Are Money Market Funds?

Imagine Money Market Funds as a collaborative financial venture. Investors pool their resources, which are then expertly managed by financial professionals who invest in a diverse portfolio of low-risk, short-term securities. It’s akin to having a team of skilled financial chefs working to enhance your money’s flavor profile without risking its core ingredients.

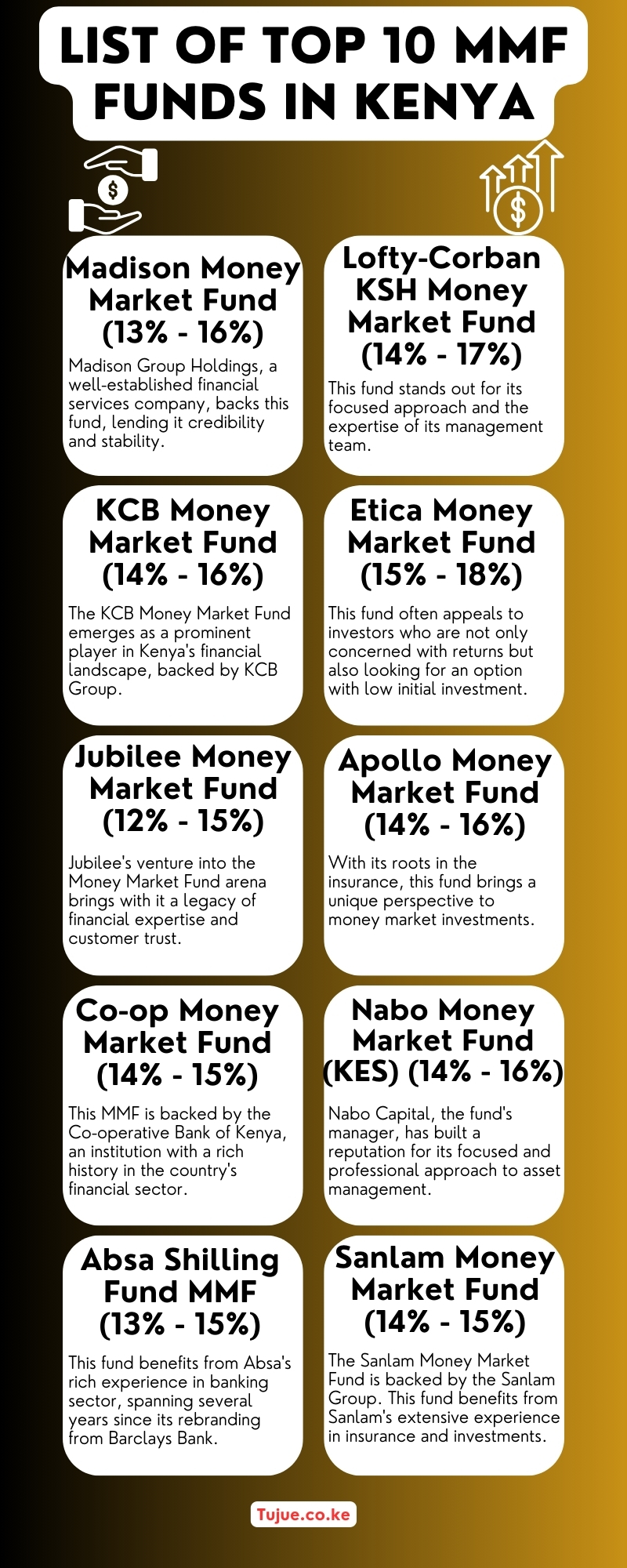

List of Top 10 MMF Funds in Kenya

Kenya boasts several high-performing Money Market Funds. Let’s examine the top contenders that have been delivering exceptional results for investors.

1. Madison Money Market Fund (13% – 16%)

Among the notable players in Kenya’s Money Market Fund space, the Madison Money Market Fund stands out due to its big name and years of operation. Madison Group Holdings, a well-established financial services company, backs this fund, lending it credibility and stability.

While past performance doesn’t guarantee future results, the fund’s endurance and the reputation of its parent company make it a noteworthy option for investors seeking a blend of experience and potential returns in Kenya’s competitive MMF market.

For new investors, Madison MMF requires:

– Initial investment: A minimum of KES 5,000

– Management Fee: 2% p.a

2. KCB Money Market Fund (14% – 16%)

The KCB Money Market Fund emerges as a prominent player in Kenya’s financial landscape, backed by the strength and reputation of KCB Group, one of East Africa’s largest commercial banks. This fund benefits from KCB’s extensive experience in the banking sector, which spans several decades.

Investors are often drawn to this fund due to the trust associated with the KCB brand and its long-standing presence in the Kenyan market. While performance should always be scrutinized independently, the KCB Money Market Fund’s connection to a major banking institution offers a sense of stability and reliability that many investors find appealing.

– Initial investment: A minimum of KES 5,000

– Management Fee: 2% p.a

3. Jubilee Money Market Fund (12% – 15%)

The Jubilee Money Market Fund stands out in Kenya’s investment scene, leveraging the reputation of Jubilee Insurance, a well-established name in East Africa’s insurance and financial services sector. With roots tracing back several decades, Jubilee’s venture into the Money Market Fund arena brings with it a legacy of financial expertise and customer trust.

This fund attracts attention not just for its competitive returns, but also for the broader financial ecosystem it’s part of within the Jubilee Group. As always, while brand recognition is valuable, investors should carefully review the fund’s specific performance metrics and investment strategy.

– Initial investment: A minimum of KES 5,000

– Management Fee: 2.22% p.a

4. Co-op Money Market Fund (14% – 15%)

Backed by the Co-operative Bank of Kenya, an institution with a rich history in the country’s financial sector, this fund appeals to investors who appreciate the bank’s ethos of community-focused banking and its extensive national presence.

While the fund’s performance should be evaluated on its own merits, the strong brand recognition and years of operation in Kenya’s financial landscape make the Co-op Money Market Fund a noteworthy contender in the MMF market.

– Initial investment: A minimum of KES 2,000

– Management Fee: 1%

5. Absa Shilling Fund MMF (13% – 15%)

This fund benefits from Absa’s extensive experience in the banking sector, which spans several years since its rebranding from Barclays Bank. The Absa Shilling Fund MMF leverages the bank’s robust financial infrastructure and expertise in money markets.

Investors are often drawn to this fund due to Absa’s strong brand recognition and its reputation for innovative financial solutions. While performance should always be evaluated independently, the Absa Shilling Fund MMF’s association with a major banking institution offers a blend of modernity and stability that appeals to many investors in the Kenyan market.

– Initial investment: Start with just KES 1,000

– Management Fee: 2% p.a

6. Lofty-Corban KSH Money Market Fund (14% – 17%)

The Lofty-Corban KSH Money Market Fund, while perhaps not as widely recognized as some of its competitors, has carved out its niche in Kenya’s investment landscape. This fund stands out for its focused approach and the expertise of its management team.

Despite not being backed by a major banking institution, the fund often attracts investors looking for alternatives to bank-affiliated MMFs, appreciating its more agile and specialized investment strategy.

A significant milestone for Lofty-Corban is reaching KES 1 billion in Assets Under Management (AUM), showcasing investor confidence and the fund’s robust growth.

Initial investment – KES 1,000

Management Fee – 2% p.a

7. Etica Money Market Fund (15% – 18%)

While it may not have the long history of some competitors, Etica has gained attention for its commitment to responsible investment practices. This fund often appeals to investors who are not only concerned with returns but also looking for an option with low initial investment.

– Initial Investment– Only KES 100

–Management Fee: 2% p.a

8. Apollo Money Market Fund (14% – 16%)

The Apollo Money Market Fund benefits from the reputation of APA Insurance, a well-established name in Kenya’s financial services sector. With its roots in the insurance, this fund brings a unique perspective to money market investments.

The Apollo Money Market Fund has built its presence over years of operation, leveraging the group’s broader financial expertise. It often attracts investors who appreciate the diversified background of its parent company and its understanding of risk management.

Initial investment – KES 1,000

Management Fee – 2% p.a

9. Nabo Money Market Fund (KES) (14% – 16%)

The Nabo Money Market Fund, while perhaps not as widely recognized as some larger bank-affiliated funds, has established itself as a noteworthy player in Kenya’s investment scene. Nabo Capital, the fund’s manager, has built a reputation for its focused and professional approach to asset management.

Despite being a relatively younger entrant compared to some competitors, the Nabo Money Market Fund has gained attention for its potentially nimble investment strategy and customer-centric approach. However, it recommends an investment of 3 months, with the minimum being investment being 100,000.

For those looking to invest with Nabo MMF:

– Initial investment – KES 100,000

-Management Fee: 2.5% p.a

10. Sanlam Money Market Fund (14% – 15%)

The Sanlam Money Market Fund stands out because it’s backed by the Sanlam Group, a well-established name in African financial services with roots tracing back over a century in South Africa. This fund benefits from Sanlam’s extensive experience across various financial sectors, including insurance and investments.

The Sanlam Money Market Fund leverages the group’s continental presence and expertise, offering a broader perspective on market dynamics.

– Initial investment: KES 2,500 required to start

-Management Fee: 1.5%

Other Top Money Market Funds in Kenya

This list is not exhaustive. There are also some other great MMF to try out in Kenya licensed by Capital Markets Authority. These include:

| Name | Average Yield p.a |

|---|---|

| African Alliance Kenya Money Market Fund | 13% – 14% |

| British-American Unit Trust Scheme | 9% – 12% |

| NCBA Money Market Fund | 10% – 13% |

| Zimele Money Market Fund | 10% – 14% |

| ICEA Money Market Fund | 10% – 13% |

| CIC Money Market Fund | 12% – 14% |

| Madison Money Market Fund | 13% – 16% |

| Mali Money Market Fund | 10% – 14% |

| Sanlam Money Market Fund | 14% – 15% |

| Nabo Africa Money Market Fund | 14% – 16% |

| Old Mutual Equity Fund | 13% – 15% |

| Equity Investment Bank Money Market Fund | 10% – 15% |

| Dry Associates Money Market Fund | 10% – 13% |

| Co-op Money Market Fund | 14% – 15% |

| Apollo Money Market Fund | 14% – 16% |

| Cytonn Money Market Fund | 15% – 18% |

| Orient Kasha Money Market Fund | 11% – 13% |

| Absa Shilling Money Market Fund | 13% – 15% |

| KCB Money Market Fund | 14% – 16% |

| GenAfrica Money Market Fund | 13% – 17% |

| Jubilee Money Market Fund | 12% – 14% |

| Enwealth Money Market Fund | 13% – 16% |

| Kuza Money Market Fund | 14% – 17% |

| Etica Money Market Fund | 15% – 18% |

| Lofty Corban Money Market Fund | 14% – 17% |

| Stanbic Money Market Fund | 14% – 16% |

| Mayfair Money Market Fund | 12% – 14% |

| ICEA LION Money Market Fund | 11% – 13% |

Choosing the Right Money Market Fund: A Comprehensive Guide

Now that we’ve explored the top-performing Money Market Funds in Kenya, it’s crucial to understand how to select the fund that best aligns with your financial objectives. Here’s an in-depth look at the key factors to consider when making your choice:

1. Performance History

Evaluating a fund’s track record is essential, although it’s important to remember that past performance doesn’t guarantee future results.

Consider the following:

– Long-term consistency: Analyze the fund’s average annual yield over various timeframes (1 year, 3 years, 5 years). This provides insight into the fund’s ability to maintain performance across different market conditions.

– Benchmark comparisons: Measure the fund’s performance against relevant benchmarks such as:

- The average yield of Money Market Funds in Kenya

- Returns on fixed deposits

- The Central Bank Rate (CBR)

2. Fees and Charges

The fee structure of a Money Market Fund can significantly impact your overall returns. Pay close attention to:

– Management fees: These ongoing charges cover the fund’s operational costs. Lower fees generally translate to higher potential returns for investors. Compare management fees across different funds to find the most cost-effective option.

– Entry/Exit fees: Some funds charge fees when you invest or withdraw money. While these may seem small, they can erode your returns over time. Look for funds with low or no entry/exit fees to maximize your investment.

– Performance fees: Certain funds implement performance-based fees, typically charged when the fund outperforms a specified benchmark. While this can incentivize strong management, carefully consider how these fees might affect your overall returns, especially in high-performing years.

3. Investment Strategy

Understanding a fund’s investment approach is crucial for assessing its risk profile and alignment with your goals:

– Asset allocation:Examine the types of securities the fund invests in. This may include:

- Government securities (e.g., Treasury bills)

- Corporate bonds

- Bank deposits

- Commercial paper

– Maturity profile: Look at the average maturity of the fund’s holdings. Shorter average maturities generally indicate lower interest rate risk but potentially lower yields.

– Risk management: Evaluate the fund’s approach to managing risks such as credit risk, interest rate risk, and liquidity risk.

4. Minimum Investment Amount

The initial investment required varies among funds:

Low minimum funds: Some funds, like GenCap Hela Imara, allow you to start with as little as KES 500, making them accessible to a wide range of investors.

– Higher minimum funds: Others, like Nabo Money Market Fund, require larger initial investments (e.g., KES 100,000). These may be more suitable for investors with larger capital.

5. Liquidity Needs

Consider how quickly you might need to access your invested funds:

– Redemption periods: Most Money Market Funds offer relatively quick access to funds, but timeframes can vary:

- Same-day access

- T+1 (next business day)

- T+2 or T+3 (within 2-3 business days)

– Withdrawal limits: Some funds may have restrictions on the amount or frequency of withdrawals. Ensure the fund’s liquidity terms align with your potential cash flow needs.

Remember:

1. Don’t hesitate to ask questions directly to the fund management company or your financial advisor. They should be able to address any concerns or clarify any aspects of the fund you don’t fully understand.

2. Consider your overall investment portfolio. A Money Market Fund should complement your other investments and align with your broader financial strategy.

3. Regularly review your investment choices. As your financial situation and goals evolve, you may need to reassess whether your chosen Money Market Fund still meets your needs.

Benefits of Investing in Money Market Funds in Kenya

Money Market Funds have become increasingly popular among Kenyan investors, offering a unique blend of safety, liquidity, and competitive returns. Let’s delve deeper into the key advantages of these investment vehicles:

1. Safety and Stability

Money Market Funds are designed with capital preservation as a primary objective, making them an attractive option for risk-averse investors:

– Low-risk investments. These funds typically invest in

- Government securities (e.g., Treasury bills)

- Short-term deposits with reputable banks

- High-quality commercial paper from blue-chip companies

– Regulatory oversight: In Kenya, Money Market Funds are regulated by the Capital Markets Authority (CMA), ensuring adherence to strict investment guidelines and operational standards.

2. Liquidity and Accessibility

One of the most appealing features of Money Market Funds is their high liquidity. You’ll get to enjoy:

– Quick redemptions: Many funds offer same-day or next-day access to your money, with some even providing T+1 (transaction plus one day) settlement.

– No lock-in periods: Unlike fixed deposits or some other investments, most Money Market Funds don’t have mandatory holding periods.

– Flexible investment amounts: Many funds allow for small initial investments and subsequent top-ups, making it easy to add to your investment as your financial situation allows.

– Online and mobile access: Most fund providers offer digital platforms for easy account management, allowing you to invest, redeem, or check your balance at your convenience.

This liquidity makes Money Market Funds suitable for:

- Emergency funds

- Short-term savings goals (e.g., for a down payment or upcoming travel)

- Cash management for businesses

3. Competitive Returns

Money Market Funds have historically offered attractive returns compared to traditional savings accounts:

– Higher yield: By investing in a diversified portfolio of money market instruments, these funds can often achieve yields that significantly outpace inflation and standard savings account rates.

– Compounding benefits: Many funds calculate and accrue interest daily, compounding monthly. This can lead to accelerated growth of your investment over time.

– Economies of scale: Large Money Market Funds can often negotiate better rates on deposits and securities due to their size, potentially passing these benefits on to investors.

Let’s take a look at a real example:

Imagine you have KES 100,000 to invest for one year:

1. Traditional savings account (6% interest):

– After one year: KES 106,000

– Interest earned: KES 6,000

2. Money Market Fund (17% average annual yield):

– After one year: KES 117,000

– Interest earned: KES 17,000

3. Money Market Fund with monthly compounding:

– After one year: KES 118,261

– Interest earned: KES 18,261

4. Professional Management

Investing in a Money Market Fund gives you access to expert financial management. You’ll get experienced fund managers who have in-depth knowledge of financial markets and use sophisticated analysis tools to make investment decisions.

List of Top 10 MMF Funds in Kenya Infographic

Happy Investing!

As we conclude our exploration of the best Money Market Funds in Kenya, it’s clear that these investment vehicles offer a compelling opportunity for both novice and experienced investors alike.

Remember, the key to successful investing lies not just in choosing the highest-yielding fund, but in selecting one that aligns with your unique financial situation, goals, and risk tolerance. Consider factors such as performance history, fees, investment strategy, minimum investment amounts, and liquidity needs when making your decision.